Understanding the cost of attending a university in the United States can be tricky! All schools publish their basic costs, such as tuition and fees, but you must also account for other factors when selecting the right school for you. Here’s a breakdown to help make sense of these costs:

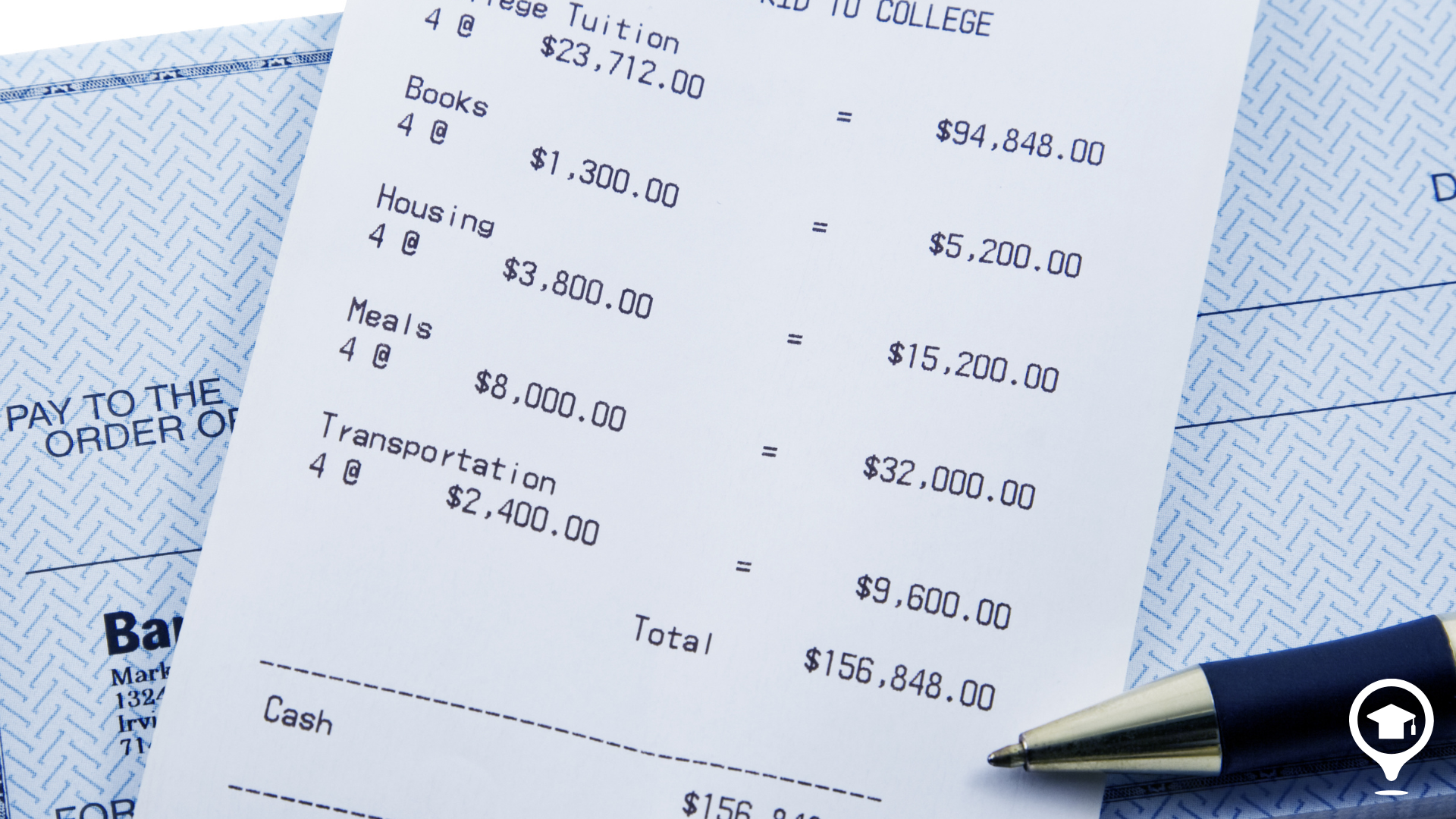

Tuition and Fees

Tuition is the primary cost for classes and instruction. Schools often list this by credit hour or as a flat rate per semester.

Fees cover additional services, such as technology, health, library, and lab resources. These can vary widely between institutions and programs.

Room and Board

This includes housing and meal plans. Living on-campus typically involves a set cost, while living off-campus may require budgeting for rent, utilities, groceries, and commuting.

Books and Supplies

Textbooks and supplies can be a significant expense, especially in certain fields (like the sciences or art). Choosing e-books, book rentals, and used books can sometimes help reduce these costs.

Personal Expenses

This covers things like clothing, personal care, transportation, and other day-to-day expenses. Students should budget for these based on their own lifestyle and spending habits.

Transportation

For commuters, this includes gas, public transportation passes, parking, and potential car maintenance. If you're far from home, it may also include occasional flights or long-distance travel for breaks.

Health Insurance

Many schools require students to have health insurance, which may come with additional costs. Some schools offer health plans for students, while others may require proof of an external plan.

Financial Aid and Scholarships

Financial aid packages typically include grants (free money), loans (which must be repaid), and work-study opportunities. Scholarships can also help significantly reduce costs; these may be based on academic merit, financial need, or other criteria.

Tips for Managing School Costs:

Use a cost calculator: Many schools offer net price calculators on their websites that can help you estimate the actual cost of your schooling after financial aid.

Research scholarships and grants: Look at internal scholarships, government grants, and private scholarships.

Budget carefully: Track your spending and set a monthly budget to avoid financial strain.

Consider part-time work: If possible, securing an on-campus or remote part-time job can help you meet your expenses without overwhelming your schedule.

Add new comment