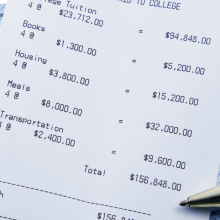

Naturally, living expenses can vary greatly depending on where students choose to attend school or their personal preferences, but a few fundamentals—housing; food; transportation; textbooks and supplies; recreation and leisure; and personal expenses—are guaranteed to add up, no matter what. Following are some basics on how to manage your expenses and your budget.

No matter where you attend school, housing will likely be the largest investment you will make. Everyone needs a place to live, shelter, and a place to lay their head. Student housing quality and cost vary widely, and it’s best to take your personal preferences into account when choosing what’s right for you. Living on campus is very convenient and can be quite appealing, but if you are interested in living in a dormitory, your housing will be contingent on the academic calendar of your school—so if you need to stay on or near campus during holidays or breaks, you’ll need to plan accordingly.

Terms for off-campus housing are sometimes based on the academic calendar of your school—particularly if it provided by or obtained with help from the institution—but you can also pursue off-campus housing options on your own, likely for a full 12-month period. Students must fully understand what they’re signing up for if they pursue either option, as they are fully responsible for all associated costs.

We all have to eat, so it’s important to leave plenty of room for food costs, which are likely to be the second largest expense in your budget. Every school offers some options for food provided by the institution, whether it takes the form of a meal plan or a pay-as-you-go outlet. Even if you have a meal plan, make room in your budget for groceries and eating out at area restaurants as well.

Your transportation budget must include the costs to travel between school and home, both at breaks and at the start and end of the school year, as well as any expenses you will encounter to commute to the campus or around the community. Some schools offer bus or trolley services for their students’ use, but these services can’t meet every need you will have. Some students budget for the expense of owning a car or two-wheeled motorized vehicle (which includes paying for insurance, maintenance, and fuel), while others choose bikes or non-motorized scooters to get around. Your transportation budget should also allow for occasional (or regular, if necessary) use of public transportation, taxis, or ride-share services like Uber or Lyft.

Unfortunately, your tuition bill doesn’t include textbooks and school supplies, so you’ll need to set aside funds for them as well. School supplies are essential to your academic success, and the costs for computers, textbooks, notebooks, class-specific supplies, and even pens add up quickly.

Academics are important, but balancing your life with a healthy level of recreation and leisure activities is also vital. Recreation activities can range in cost from free campus events to club or gym memberships to costly concert tickets, so be sure to leave room in your bank account for them!

Last, but not least, it’s important to take care of yourself. Your personal expenses, which may include clothing, furnishings, toiletries, personal grooming supplies or services, or mobile phone costs, can add up quickly.

Creating and maintaining a budget requires cautious tracking of your expenses to manage your finances effectively. Don’t miss opportunities to obtain student discounts, scholarships, or part-time work opportunities that can help alleviate some of the financial burdens associated with being a college student.

Add new comment